Meet the Fastest

Mortgage Lenders in Houston

There are plenty of qualified mortgage lenders in Houston, TX. But only one of them can be the fastest mortgage lender in America. Welcome to Zeus Mortgage Bank. We aren’t like the other mortgage lenders in Houston. We close all of our mortgage loans faster than our competition. Most of the time, it’s not even close. As a mortgage lender, we prioritize speed because we know that when it comes to closing on a home or an investment property, timing matters. That’s why our Houston mortgage lending experts contact every loan applicant as quickly as possible to go over their mortgage options in detail.

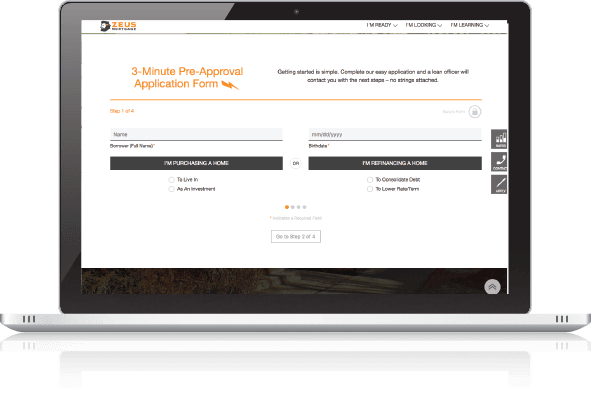

Apply in Just 3 MinutesIt All Starts With Our

Fast and Easy 3-Minute

Mortgage Loan Application

It only takes 180 seconds to tell Zeus Mortgage Bank everything we need to know to get started processing your mortgage loan in Houston. You won’t have to wait weeks to receive your mortgage loan terms. Zeus Mortgage Bank loans take only days from loan application to closing. We pride ourselves on being the fastest mortgage lenders in Houston, TX, and we ensure that no one in Houston or anywhere else in the United States can provide a conventional mortgage loan faster than Zeus Mortgage Bank. Not convinced? Fill out our 3-minute mortgage loan application now—there’s no obligation to you!

Apply in Just 3 Minutes

Zeus Mortgage Bank Isn’t Just Fast. We’re Flexible, Too!

Our mortgage lender services are the best in Houston. Once we receive your mortgage loan application, our lending experts will contact you shortly to discuss your options. Even if you’ve been denied for a mortgage loan in the past, Zeus Mortgage Bank will do our due diligence to find a lending method that will work for you. That’s the Zeus Mortgage Bank difference: We’re the only mortgage lender in Houston willing to go above and beyond for every applicant with no strings attached. That’s the level of customer service that borrowers expect in Texas, and Zeus Mortgage Bank considers it only neighborly to provide it to every person who fills out our fast, simple 3-minute mortgage loan application. What are you waiting for? Fill out our 3-minute application now and see how much time and money three minutes could save you over those other Houston mortgage lenders!

Apply in Just 3 MinutesCLIENT GOSSIP

- ZEUS IN THE NEWS